Why is Demand for Chillers Increasing in MEA?

The Middle East and African chiller market growth is driven by the booming construction industry and the increasing adoption of chillers for district cooling systems. The construction industry is growing because of the increasing expenditure in the infrastructure sector by governments for events, such as the FIFA World Cup 2020 and the Dubai Expo 2020. These factors are expected to increase the market size from $1.1 billion in 2018 to $1.3 billion by 2024, while demonstrating a CAGR of 3.6% during the forecast period (2019–2024).

In the MEA region, metro stations, supermarkets, offices and buildings, and railways are shifting toward magnetic bearing chillers from standard centrifugal chillers. The shift is because of the low maintenance cost attached to the magnetic chillers. Chillers based on magnetic bearing technology have less number of moving parts that need no oil lubrication, thereby, requiring less service and maintenance. Moreover, these chillers are lightweight, more efficient, and emit less noise in comparison to the standard centrifugal chillers.

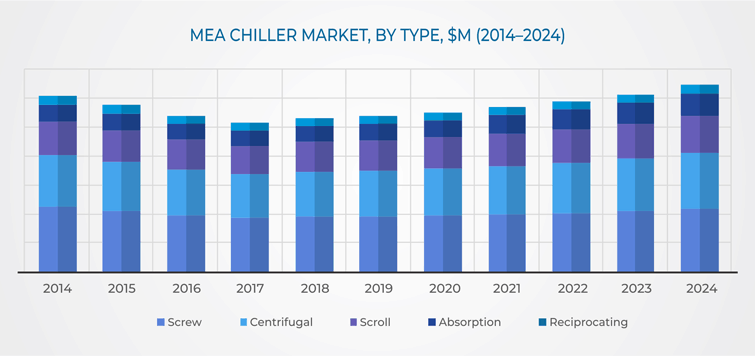

Categories under the type segment of the Middle East and African chiller market include reciprocating, screw, scroll, absorption, and centrifugal. Among these, the screw category held the largest market share in 2018, due to the large-scale adoption of screw chillers in the end-use sectors, such as industrial and commercial. In the commercial sector, hotels, especially in the U.A.E., deployed the highest number of screw chillers during the historical period. Additionally, the upcoming Dubai Expo 2020 is expected to increase the demand for these chillers in coming years, due to the construction of new hotels.

The different types of chillers find applications in other commercial sectors, such as transportation, healthcare, offices and buildings, government, and supermarket/hypermarket. Due to the expansion of the metro transit system, countries, such as Israel, Saudi Arabia, the U.AE., Qatar, Egypt, and Nigeria, are expected to adopt a large number of chillers in the transportation sector. Moreover, chillers are also used in large numbers in the industrial sector like automotive, food and beverage, textile, energy and utilities, electronics, oil & gas, cement, and pharmaceutical.

Among MEA countries, Saudi Arabia deploys the maximum number of chillers, owing to the increase in construction activities under the Saudi Vision 2030 and the National Transformation Programme (NTP). In 2018, contracts worth $23.81 billion were accorded for the construction of buildings and other infrastructure facilities. For example, the new NEOM city along the coast of Saudi Arabia is a $500 billion plan that would encompass manufacturing units of industries, such as food and beverage, water desalination, and biotechnology; commercial buildings like metros, airports, residential units, sports and entertainment venues, and ports. These facilities will, in turn, deploy a large number of chillers in coming years.

Further, the Middle East and African chiller market is characterized by the presence of few players that are involved in facility expansions, client wins, and product launches. Some of the top players in the market include Johnson Controls International plc, GAMI Air Conditioners Manufacturing Company L.L.C., Ingersoll-Rand plc, Midea Group Co. Ltd., United Technologies Corporation, Petra Engineering Industries Co., Mitsubishi Electric Corporation, S.K.M Air Conditioning LLC, and Zamil Air Conditioners.

Thus, the surging demand for chillers in the MEA region is due to the increasing construction of hotels, metro stations, railway facilities, residential units, and production units.

Read More: https://www.psmarketresearch.com/market-analysis/mea-chiller-market

The Middle East and African chiller market growth is driven by the booming construction industry and the increasing adoption of chillers for district cooling systems. The construction industry is growing because of the increasing expenditure in the infrastructure sector by governments for events, such as the FIFA World Cup 2020 and the Dubai Expo 2020. These factors are expected to increase the market size from $1.1 billion in 2018 to $1.3 billion by 2024, while demonstrating a CAGR of 3.6% during the forecast period (2019–2024).

In the MEA region, metro stations, supermarkets, offices and buildings, and railways are shifting toward magnetic bearing chillers from standard centrifugal chillers. The shift is because of the low maintenance cost attached to the magnetic chillers. Chillers based on magnetic bearing technology have less number of moving parts that need no oil lubrication, thereby, requiring less service and maintenance. Moreover, these chillers are lightweight, more efficient, and emit less noise in comparison to the standard centrifugal chillers.

Categories under the type segment of the Middle East and African chiller market include reciprocating, screw, scroll, absorption, and centrifugal. Among these, the screw category held the largest market share in 2018, due to the large-scale adoption of screw chillers in the end-use sectors, such as industrial and commercial. In the commercial sector, hotels, especially in the U.A.E., deployed the highest number of screw chillers during the historical period. Additionally, the upcoming Dubai Expo 2020 is expected to increase the demand for these chillers in coming years, due to the construction of new hotels.

The different types of chillers find applications in other commercial sectors, such as transportation, healthcare, offices and buildings, government, and supermarket/hypermarket. Due to the expansion of the metro transit system, countries, such as Israel, Saudi Arabia, the U.AE., Qatar, Egypt, and Nigeria, are expected to adopt a large number of chillers in the transportation sector. Moreover, chillers are also used in large numbers in the industrial sector like automotive, food and beverage, textile, energy and utilities, electronics, oil & gas, cement, and pharmaceutical.

Among MEA countries, Saudi Arabia deploys the maximum number of chillers, owing to the increase in construction activities under the Saudi Vision 2030 and the National Transformation Programme (NTP). In 2018, contracts worth $23.81 billion were accorded for the construction of buildings and other infrastructure facilities. For example, the new NEOM city along the coast of Saudi Arabia is a $500 billion plan that would encompass manufacturing units of industries, such as food and beverage, water desalination, and biotechnology; commercial buildings like metros, airports, residential units, sports and entertainment venues, and ports. These facilities will, in turn, deploy a large number of chillers in coming years.

Further, the Middle East and African chiller market is characterized by the presence of few players that are involved in facility expansions, client wins, and product launches. Some of the top players in the market include Johnson Controls International plc, GAMI Air Conditioners Manufacturing Company L.L.C., Ingersoll-Rand plc, Midea Group Co. Ltd., United Technologies Corporation, Petra Engineering Industries Co., Mitsubishi Electric Corporation, S.K.M Air Conditioning LLC, and Zamil Air Conditioners.

Thus, the surging demand for chillers in the MEA region is due to the increasing construction of hotels, metro stations, railway facilities, residential units, and production units.

Read More: https://www.psmarketresearch.com/market-analysis/mea-chiller-market

Why is Demand for Chillers Increasing in MEA?

The Middle East and African chiller market growth is driven by the booming construction industry and the increasing adoption of chillers for district cooling systems. The construction industry is growing because of the increasing expenditure in the infrastructure sector by governments for events, such as the FIFA World Cup 2020 and the Dubai Expo 2020. These factors are expected to increase the market size from $1.1 billion in 2018 to $1.3 billion by 2024, while demonstrating a CAGR of 3.6% during the forecast period (2019–2024).

In the MEA region, metro stations, supermarkets, offices and buildings, and railways are shifting toward magnetic bearing chillers from standard centrifugal chillers. The shift is because of the low maintenance cost attached to the magnetic chillers. Chillers based on magnetic bearing technology have less number of moving parts that need no oil lubrication, thereby, requiring less service and maintenance. Moreover, these chillers are lightweight, more efficient, and emit less noise in comparison to the standard centrifugal chillers.

Categories under the type segment of the Middle East and African chiller market include reciprocating, screw, scroll, absorption, and centrifugal. Among these, the screw category held the largest market share in 2018, due to the large-scale adoption of screw chillers in the end-use sectors, such as industrial and commercial. In the commercial sector, hotels, especially in the U.A.E., deployed the highest number of screw chillers during the historical period. Additionally, the upcoming Dubai Expo 2020 is expected to increase the demand for these chillers in coming years, due to the construction of new hotels.

The different types of chillers find applications in other commercial sectors, such as transportation, healthcare, offices and buildings, government, and supermarket/hypermarket. Due to the expansion of the metro transit system, countries, such as Israel, Saudi Arabia, the U.AE., Qatar, Egypt, and Nigeria, are expected to adopt a large number of chillers in the transportation sector. Moreover, chillers are also used in large numbers in the industrial sector like automotive, food and beverage, textile, energy and utilities, electronics, oil & gas, cement, and pharmaceutical.

Among MEA countries, Saudi Arabia deploys the maximum number of chillers, owing to the increase in construction activities under the Saudi Vision 2030 and the National Transformation Programme (NTP). In 2018, contracts worth $23.81 billion were accorded for the construction of buildings and other infrastructure facilities. For example, the new NEOM city along the coast of Saudi Arabia is a $500 billion plan that would encompass manufacturing units of industries, such as food and beverage, water desalination, and biotechnology; commercial buildings like metros, airports, residential units, sports and entertainment venues, and ports. These facilities will, in turn, deploy a large number of chillers in coming years.

Further, the Middle East and African chiller market is characterized by the presence of few players that are involved in facility expansions, client wins, and product launches. Some of the top players in the market include Johnson Controls International plc, GAMI Air Conditioners Manufacturing Company L.L.C., Ingersoll-Rand plc, Midea Group Co. Ltd., United Technologies Corporation, Petra Engineering Industries Co., Mitsubishi Electric Corporation, S.K.M Air Conditioning LLC, and Zamil Air Conditioners.

Thus, the surging demand for chillers in the MEA region is due to the increasing construction of hotels, metro stations, railway facilities, residential units, and production units.

Read More: https://www.psmarketresearch.com/market-analysis/mea-chiller-market

0 Kommentare

0 Anteile

1KB Ansichten

0 Vorschau